Closing the calendar year (or any period you wish) in Odoo is not a difficult process but it does require some understanding of the default Odoo Balance Sheet Report. Some readers may be familiar with the use of an Income Summary account for closing entries. In this method all revenue, expenses, and dividends paid are re-classified through a clearing account in order to post the Net Income into Retained Earnings.

Odoo instead has a built in mechanism that allows a company to "Allocate" or recognize their retained earnings without using any temporary accounts. I appreciate this concept because it means that when running your historical Profit and Loss for year end, all of the revenue and expense accounts continue to represent their values instead of being re-classified into a closing entry.

The process is really quite simple. For customers using the United States Fiscal Position, Odoo will pre-install the account "999999 - Current Year Earnings". This account serves only one purpose, and that is to allocate retained earnings during a given period. Some customers may choose to "Allocate" earnings after each month or quarter, but that is really just a preference and is not required.

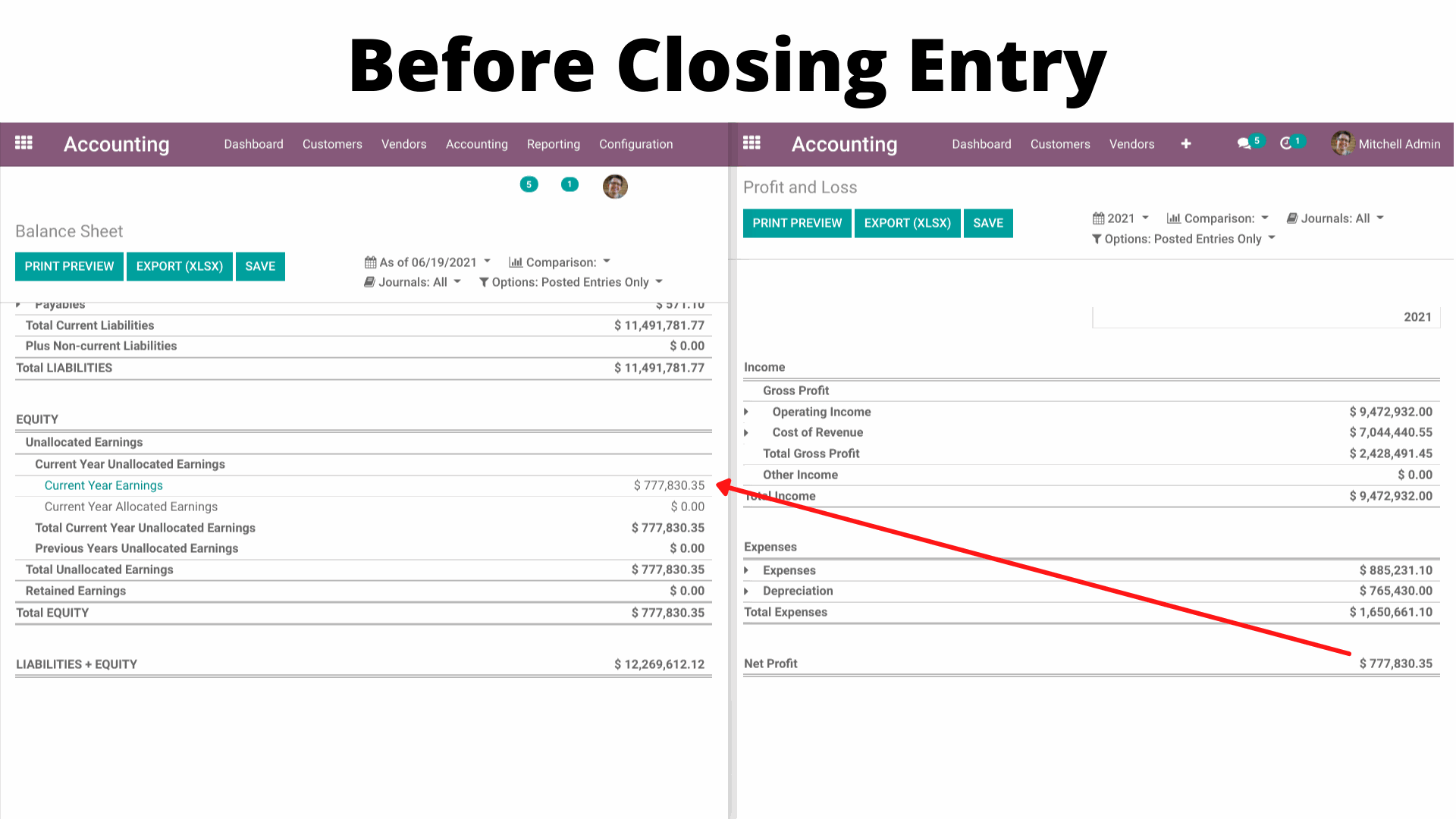

A reader of the Balance Sheet report will see their Current Year Earnings reflected in the bottom "Equity" section of the report. This number should always tie to the "Net Profit" value on the Profit and Loss report.

Please note that it is possible to change these formulas so proceed with caution if you do so. We highly recommend copying the original report before making any edits to formulas to make sure you do not lose the originals.

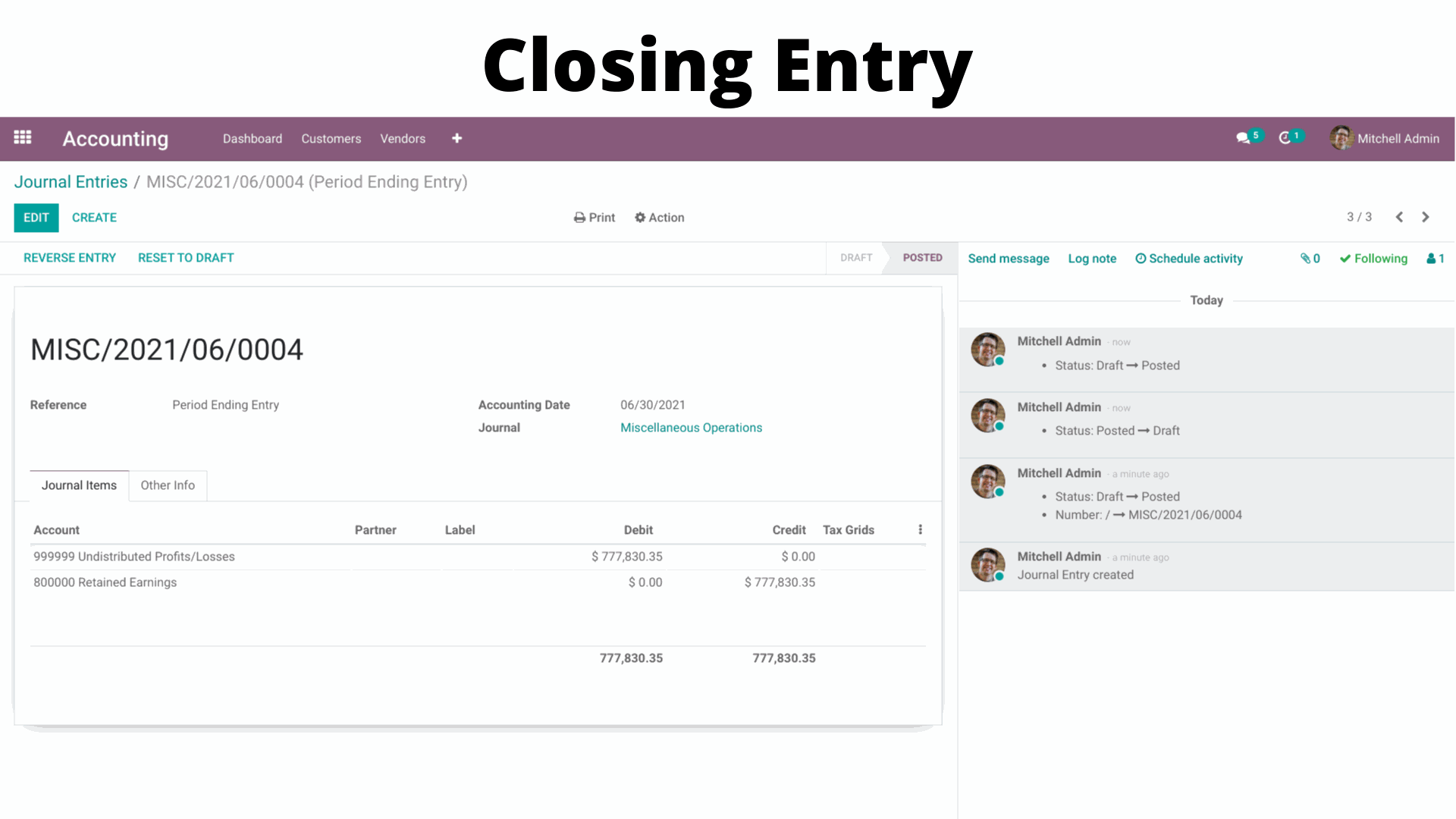

After viewing the Current Year Earnings, and paying any necessary Dividends, a closing journal entry should be made between your Retained Earnings Account and the pre-installed 999999 Account. Obviously, you will want to pay close attention to the dates that you are posting your entry to properly recognize your retained earnings.

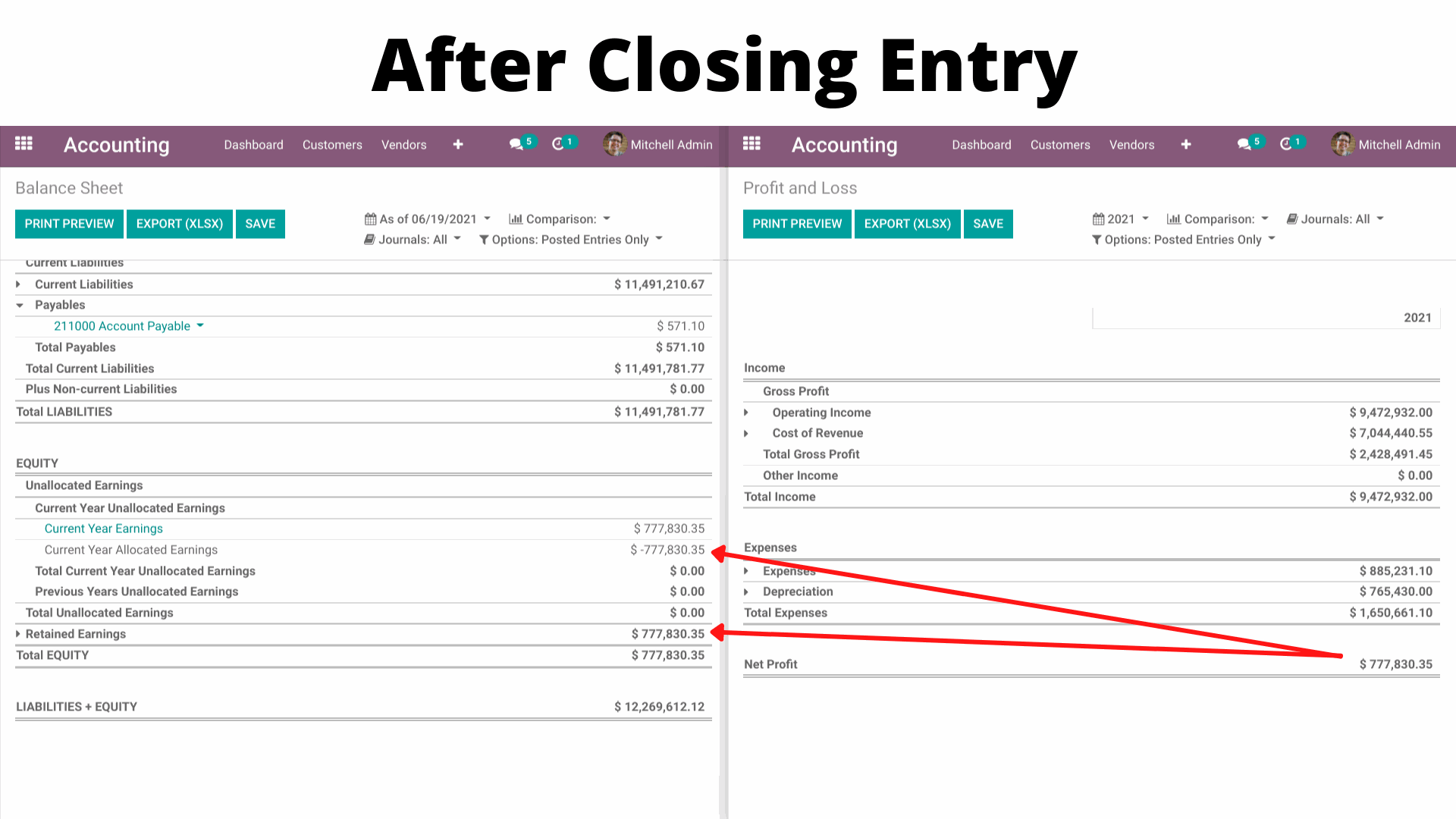

After your entry is complete, your Balance Sheet will now move your "Unallocated Earnings" into the "Allocated Earnings" section and your Retained Earnings balance will be updated accordingly.

This simple process can be repeated as frequently as you choose to recognize the income of the company and should be done in accordance with "Locking" the period so that no further adjustments could be made. Please note, if you do attempt to customize the Balance Sheet report this section may not remain and a temporary income clearing account could be employed in that case.

For more information on this process, I recommend this video: